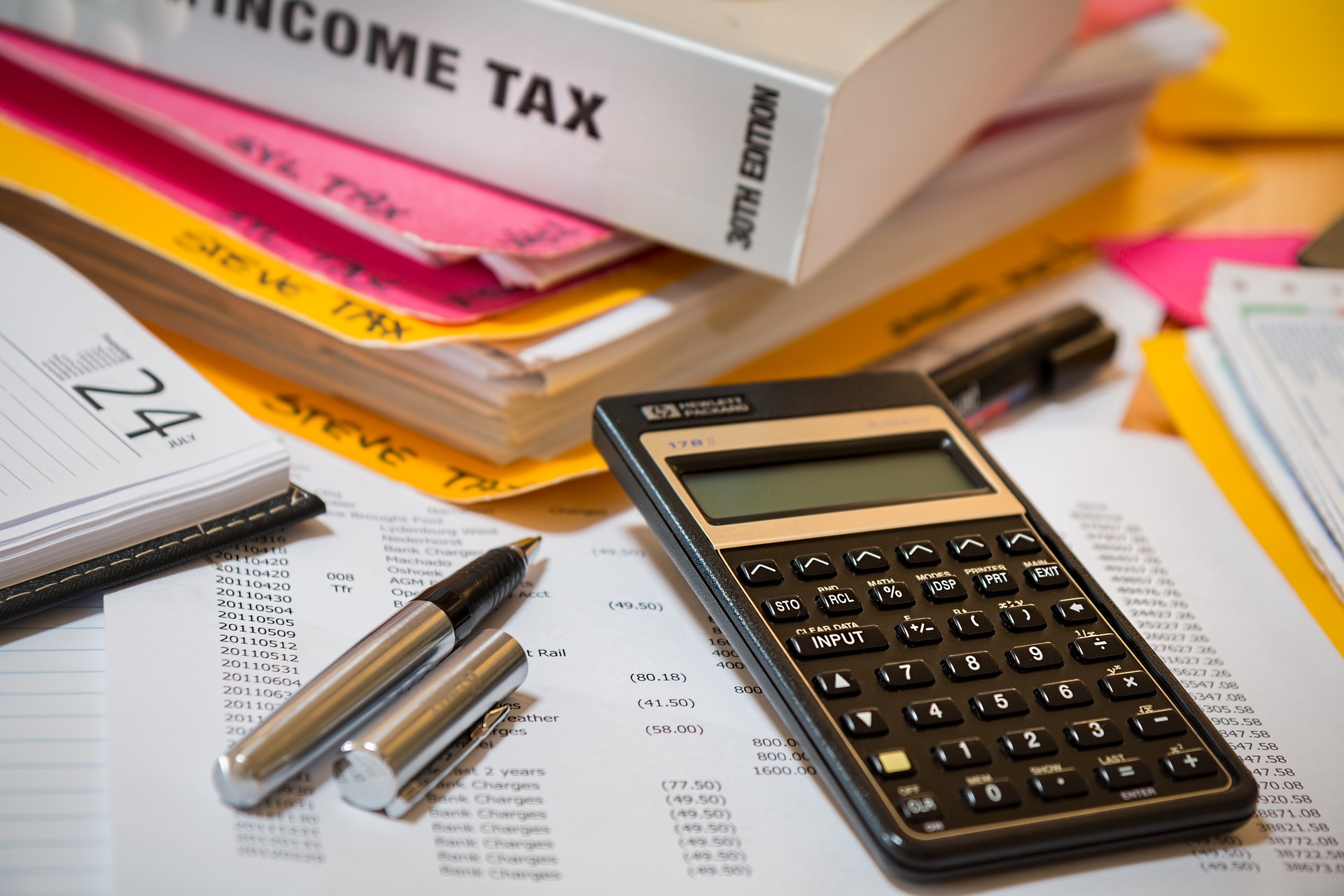

does kansas have an estate or inheritance tax

Kansas Inheritance and Gift Tax. Estate tax of 08 percent to 16 percent on estates above 5 million.

State Death Tax Is A Killer The Heritage Foundation

Another states inheritance laws may apply however if you inherit money or assets.

. 08 percent to 16 percent on estates above 1 million. You would pay 95000 10 in inheritance taxes. While each state sets its own laws regarding inheritance taxes the majority of US.

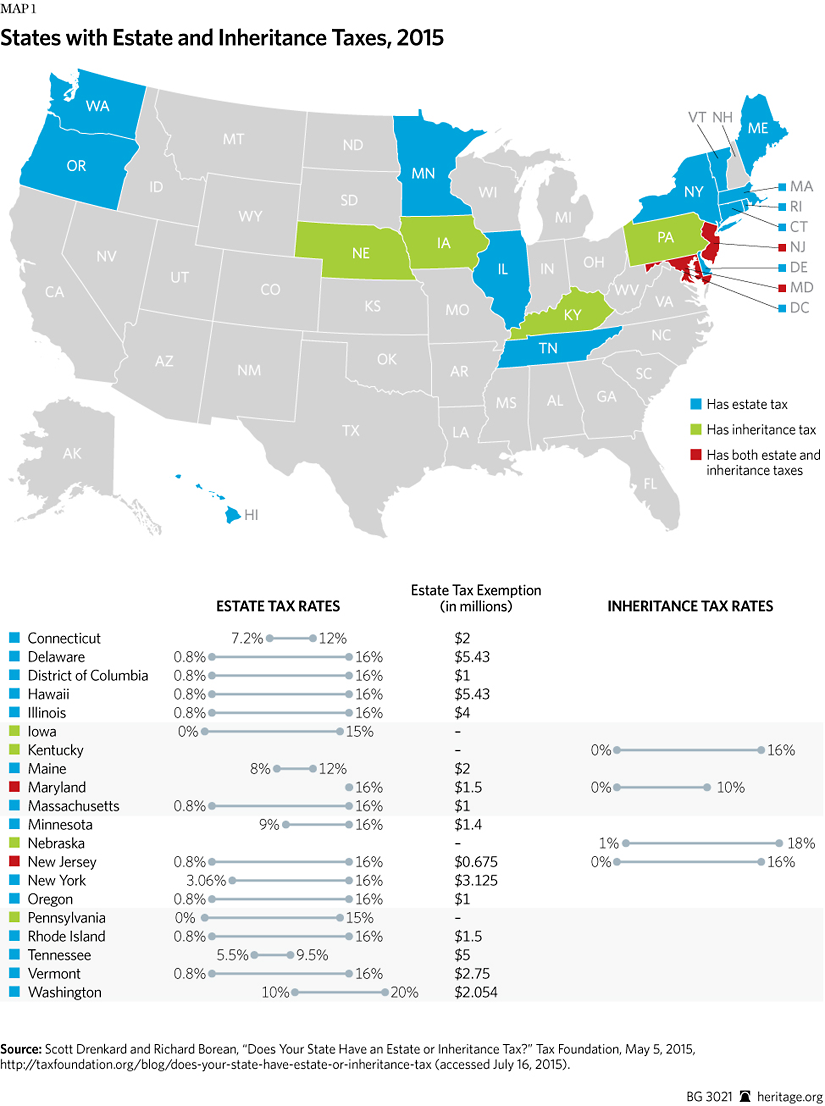

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. The state with the highest maximum estate tax rate is Washington 20 percent followed by. States including Kansas do not have estate or inheritance taxes in place as of 2013.

The District of Columbia moved in the. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Inheritance tax of up to 10 percent.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The estate tax is not to be confused with the inheritance tax which is a different tax. Kansas does not collect an estate tax or an inheritance tax.

You may also need to file some taxes on behalf of the deceased. However if you are inheriting property from another state that state may have an estate tax that applies. Kansas has no inheritance tax either.

I would file a Kansas estate tax return if there are assets that would benefit from a step up in basis like real property or investments. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Only 14 States impose estate taxes.

You would receive 950000. You would owe Kentucky a tax on your inheritance because Kentucky is one of the six states that collect a state inheritance tax. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

Does Indiana have inheritance or estate taxes. However if you are inheriting property from another state that state may have an estate tax that applies. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. While California does not have an inheritance tax the state does have some. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. While each state sets its own laws regarding inheritance taxes the majority of us. There wont be a tax to pay but the reported increases in asset bases will be valuable when the beneficiaries sell the assets in.

Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance. The first source I looked at was incorrect. Just five states apply an inheritance tax.

Kansas does not have an inheritance tax. Currently fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. Exemption levels rise to 12 from 7.

In addition to the federal estate tax of 40 percent which is Facts Figures. Maryland and New Jersey have both. Some states have inheritance tax some have estate tax some have both some have none at all.

Sorry for the confusion. Exemption threshold for Class B beneficiaries. A federal estate tax is in effect as of 2021 but the exemption is significant.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. Estate Tax And Inheritance Tax In Kansas Estate Planning States With No Estate Tax Or Inheritance Tax Plan Where You Die The New Death Tax In The Biden Tax Proposal Major Tax Change Kansas Legal Services Annuity Beneficiaries. Kansas does not collect an estate tax or an inheritance tax.

There are 12 states that have an estate tax. New Jersey phased out its estate tax in 2018. However if you are inheriting property.

Class A beneficiaries which is the majority pay no inheritance tax. Kansas does not collect an estate tax or an inheritance tax. The inheritance tax applies to money or assets after they are already passed on to a persons heirs.

North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. The top inheritance tax rate is 16 percent exemption threshold for Class C beneficiaries. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

You may also need to file. The state sales tax rate is 65. The flip side is if you live in Kentucky and your uncle lived in California at the time of his death.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. New Jersey Nebraska Iowa Kentucky and Pennsylvania. The estate would pay 50000 5 in estate taxes.

Estate tax of 8 percent to 12 percent on estates above 58 million. Inheritance tax of up to 16 percent. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

No estate tax or inheritance tax Kentucky. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Beneficiaries are responsible for paying the inheritance tax on what they inherit.

Just five states apply an inheritance tax. Massachusetts and oregon have the lowest exemption levels at 1 million and connecticut has the highest exemption level at 71.

States You Shouldn T Be Caught Dead In Wsj

401 K Inheritance Tax Rules Estate Planning

State Estate And Inheritance Taxes Itep

Estate Tax And Inheritance Tax In Kansas Estate Planning

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

What Are The Inheritance Rules In The Usa Us Property Guides

Inheritance Tax Rise Since 2008 Highest Point Ever Since 1980

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

Inheritance Tax Will Planning Solutions Will Planning Solutions Will Writing Family Protection Trust

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation